Congratulations on graduating and entering the working world! Now comes the inevitable dilemma faced by many millennials, especially those working in the Klang Valley but originally from out-of-town. Should you invest in buying a house or splurge on that shiny new car? It’s a tough decision, but don’t worry; we’ll weigh the pros and cons to help you make the right choice.

Buying a house certainly has its advantages. It offers investment potential and tends to appreciate in value over time. Moreover, owning a home provides you with a sense of security and independence once you’re ready to move out of your parents’ house or college dorm. However, it’s essential to consider the substantial initial down payment and the complexities of the home-buying process.

On the other hand, there’s the allure of the freedom a car can provide. With a car, you can easily travel and explore new places with friends, making your social life more exciting. However, it’s worth noting that a car’s value depreciates rapidly the moment it leaves the showroom, making it a less sound financial investment compared to a property.

So, let’s delve into the pros and cons to help you decide which option suits you best:

- Investment Potential

- House: Buying a property can be a long-term investment, as real estate tends to appreciate over time, potentially yielding significant returns in the future.

- Car: A car is a depreciating asset, and its value drops considerably over time. It may not offer the same investment potential as a property.

- Financial Commitment

- House: Owning a home involves a substantial initial down payment, monthly mortgage installments, and other related costs like maintenance and property taxes.

- Car: While the initial cost of a car may be lower than a house, don’t forget to consider ongoing expenses such as fuel, insurance, maintenance, and parking fees.

- Mobility and Convenience

- House: Owning a home provides stability and a place to call your own. It offers a sense of belonging and roots in a community.

- Car: Having a car grants you the freedom to travel at your convenience, which is especially beneficial in a bustling city like Klang Valley.

- Future Planning

- House: Buying a house lays the foundation for long-term financial planning and stability. It can be a stepping stone towards building assets and wealth.

- Car: While a car is essential for convenience, it might not contribute significantly to your long-term financial goals.

Ultimately, the decision boils down to your priorities and financial situation. Assess your long-term goals, affordability, and lifestyle preferences to make the right choice. Remember, both options have their merits, and the key is to strike a balance between practicality and enjoyment.

What’s The Cost?

Before making any hasty decisions, it’s crucial to consider not only the upfront price of the car or house you want to buy but also all the additional costs associated with the ownership. These additional expenses can significantly impact your financial commitment and ability to afford the purchase comfortably.

When it comes to buying a house, you must take into account various expenses, such as insurance, maintenance fees, lawyer fees, and regular upkeep costs. Some properties may require renovations or assessment fees, which should also be factored into the total cost of ownership.

On the other hand, if you’re considering purchasing a car, it’s essential to keep in mind the maintenance expenses. This includes costs related to regular servicing, potential repairs, and the price of spare parts. If you’re considering a second-hand car, there might be additional expenses for repairs or repainting, which need to be considered as well.

By accounting for all these extra expenditures, you can assess whether you can genuinely afford the purchase. It’s crucial to have a clear understanding of your overall budget and financial capability to ensure that buying a house or a car won’t strain your finances in the long run. Taking a holistic view of the net cost will help you make a more informed and responsible decision about your purchase, considering both the initial price and the ongoing expenses involved.

Expenses and Income

After considering the upfront costs and additional expenses, it’s essential to evaluate your monthly financial commitments. Apart from the loan you might take from the bank, which includes interest payments, there are ongoing costs associated with owning a house or a car.

For car ownership, you’ll need to budget for regular maintenance costs such as servicing, tolls, and petrol. On the other hand, owning a house will likely incur monthly expenses like internet, electricity, and water bills, in addition to the mortgage payments.

To determine whether you can take on these long-term commitments, it’s crucial to assess your monthly savings and income. A general rule of thumb in personal finance is that up to 50 percent of your net income should be allocated for essential monthly commitments, which include housing loans, car loans, insurance premiums, and utility bills. Another 30 percent can be budgeted for food and other recreational activities, while a minimum of 10 to 20 percent should be saved for retirement and emergencies.

By following this guideline, you can ensure that your finances are well-balanced, and you don’t overextend yourself with excessive monthly expenses. It’s crucial to have a clear understanding of your income, expenses, and savings to make informed decisions about whether buying a house or a car fits within your financial capacity. Remember, responsible financial planning is key to achieving long-term stability and security.

Let’s Imagine This

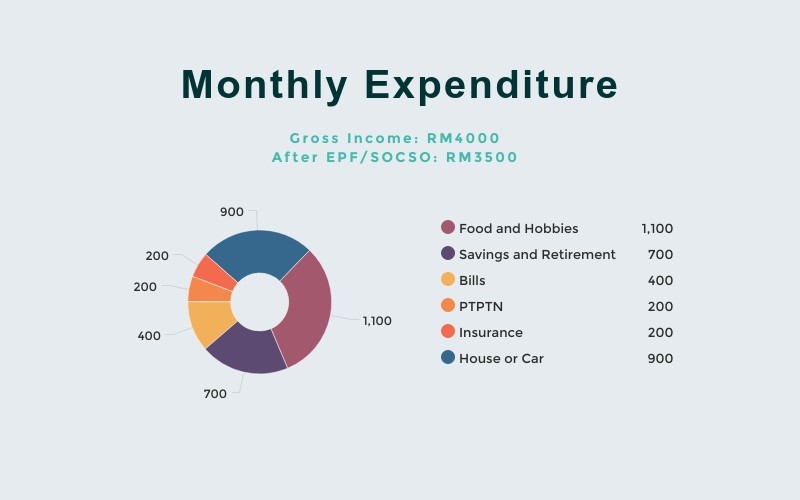

Let’s have some fun with numbers and consider a hypothetical scenario. Imagine your gross income is RM4,000, and after taxes and EPF deductions, you are left with around RM3,500. Following the advice given earlier, here’s a pie chart breakdown of your monthly savings:

- RM1,100 allocated for food and hobbies

- RM700 set aside for savings and retirement

- The remaining RM1,700 is reserved for your monthly commitments.

Now, with RM1,700 available for monthly commitments, let’s consider your existing expenses:

- PTPTN payment: RM200

- Health insurance: RM200

- Bills (utilities, etc.): RM400

After accounting for these expenses, you are left with about RM900 in disposable income. This amount represents the funds you have available for either purchasing a car or considering a house.

Based on these numbers, you now have a better gauge of your financial situation and whether you can afford a house or a car. Remember, it’s essential to be prudent in your financial decisions and choose an option that fits comfortably within your budget. Taking into account your monthly commitments and savings goals will help you make a responsible and informed choice, ensuring a secure and stable financial future.

Your Credit Scoring

Before making any long-term commitments like buying a house or a car, it’s crucial to assess your current debts and credit rating. If you already have monthly payments for student loans, personal loans, or other debts, it’s essential to consider whether taking on more debt is a wise move for your financial situation at this moment. Applying the rule of thumb for personal finance, check if your total debt amounts to more than 50 percent of your monthly commitments.

While the saying “not all debt is bad” holds some truth, it’s important to be responsible with your financial obligations. Maxing out your credit card or accumulating excessive debt can lead to financial strain and negatively impact your credit rating. However, having a reasonable level of commitment, such as timely repayment of loans and responsible credit card usage, can help establish a positive credit history.

Your credit rating plays a significant role when you approach banks or financial institutions for a loan, whether it’s for a car or a house. The bank uses your credit rating to assess your creditworthiness and determine the appropriate interest rate on the loan they’ll provide you. A good credit rating signifies that you are a reliable borrower, and it increases the likelihood of getting a loan with more favourable terms.

Therefore, it’s essential to manage your debts responsibly and maintain a positive credit rating. This can be achieved by making timely repayments on your existing loans and ensuring that your credit card usage is within reasonable limits. Taking these steps will enhance your financial credibility and increase the chances of securing a loan with favourable terms when you decide to purchase a car or a house.

Do You Really Need It?

In general, a house is often considered a valuable and worthwhile investment compared to a car, which is typically viewed as a liability. While the value of a house might experience short-term stagnation or a slight decrease, in the longer term (particularly over five to ten years), it tends to appreciate, making it a favourable long-term investment. On the other hand, the value of a car continues to depreciate over time, making it a less financially rewarding choice in the long run.

However, alongside considering the investment aspect, you must also take into account your current needs. If you live far from your workplace or reside in an area with limited public transportation options, having a car becomes more of a necessity rather than just a want. In such situations, owning a car becomes essential for your daily commute and mobility.

So, while buying a house makes sense from an investment standpoint, you must also assess your immediate requirements and how a car might fulfil those needs. Balancing the long-term financial benefits of owning a house with the practicality of having a car for daily transportation is essential in making a well-informed decision. Ultimately, it’s about finding the right balance between your long-term financial goals and your current lifestyle needs.