Ever wondered why your loan application gets accepted by one bank but rejected by another? It all boils down to your credit history, and in Malaysia, the key player is the Central Credit Reference Information System (CCRIS). This guide will help you understand CCRIS, access your report, and get the most out of it.

Think of CCRIS as your credit report card, compiled by Bank Negara Malaysia (BNM) using information from:

- Banks

- Insurance providers

- Development financial institutions

- Payment instrument issuers

- Credit leasing companies

- Government agencies

- Private utility companies

This report paints a picture of your borrowing habits for the past year, helping financial institutions decide whether to trust you with a loan.

What’s on your CCRIS report?

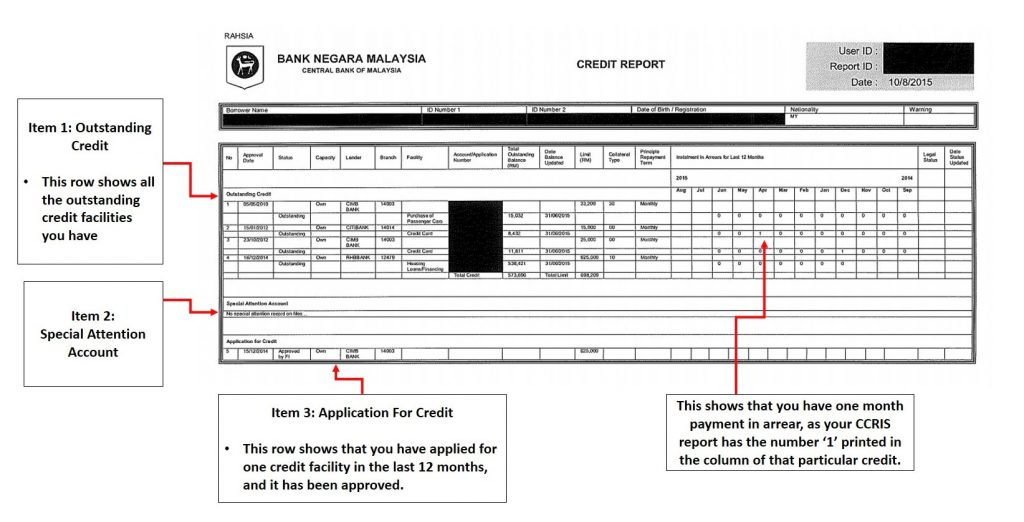

The CCRIS report provides credit-related information on a potential borrower. The information included covers three major areas:

- Outstanding Credit: All your current loans and credit cards, including joint ones and business loans.

- Special Attention Accounts: Loans under close watch by the lender due to potential repayment issues.

- Credit Applications: Any loan applications you’ve made in the past year, both approved and rejected.

Remember:

- You can’t stop BNM from collecting your credit information.

- The report only shows outstanding or active accounts, pending credit applications, and approved credit applications for the last 12 months.

Who can see your CCRIS report?

Several parties can access your report with proper permission:

- Financial institutions: When you apply for a loan, they need to know your credit history.

- You: It’s your right to check your own report and understand your credit health.

- Approved credit reporting agencies: With your consent, they can provide their own credit reports with additional information.

- Companies: You or your company can access credit reports for business purposes with proper authorization.

- Credit Reporting Agencies – These are private companies with their own credit reports. They are regulated by BNM and can only access the CCRIS report with consent from the borrower. Credit reporting agencies include CTOS Data Systems Sdn. Bhd. (CTOS), Credit Bureau Malaysia Sdn. Bhd. (CBM), and Experian Information Services (Malaysia) Sdn Bhd.

How to access your CCRIS report?

Three options are available:

- eCCRIS portal: The easiest and free option! Register online, but requirements vary depending on your situation.

- CCRIS kiosks: Head to any AKPK office nationwide, insert your MyKad, and verify with your thumbprint.

- Credit reporting agencies: These are private companies with their own credit reports. Unlike the previous two methods which are free, these Credit Reporting Agencies may charge a fee for their services. You can get your report via this method through the following agencies: CTOS Data Systems Sdn. Bhd. (CTOS), Credit Bureau Malaysia Sdn. Bhd. (CBM), Experian Information Services (Malaysia) Sdn. Bhd. (formerly known as RAM Credit Information Sdn. Bhd.)

Important Note :

eCCRIS was set up for Malaysians to be able to access and retrieve their credit reports conveniently, anywhere and anytime. They can also submit data verification requests directly to participating banks and BNM.

How do I register eCCRIS?

Beginning on February 18, 2022, eCCRIS enables Malaysian individuals possessing a MyKad and access to internet banking to register directly online, eliminating the necessity for physical presence at BNM or AKPK locations for registration authentication.

New users’ identities will be digitally confirmed through a process involving a RM1 transfer to a designated Bank Negara Malaysia account via internet banking. This measure is implemented to safeguard that only legitimate financial consumers are seeking registration on eCCRIS.

The RM1 will be automatically refunded within 2 working days upon registration. If authentication is successful, the new user will receive a 6-digit OTP to their registered mobile number and email to complete your registration.

For Malaysian individuals with MyKad but without internet banking facility or bank account, you can register via one of the following methods:

- CCRIS kiosks at any AKPK offices nationwide

- eLINK by submitting completed application form and supporting documents. The form can be downloaded from the following link.

For companies, businesses or non-individuals, you must appoint an authorized person to register via eLINK by submitting a completed application form and supporting documents. For non-Malaysian individuals, you can register yourself directly via the same method.

How lenders use your CCRIS report?

CCRIS doesn’t give a single credit score, but it tells a story. Lenders look for:

- Consistent repayment history: Showing you handle debt responsibly.

- Few defaults or missed payments: Indicating you pay on time.

- Manageable debt ratio: Keeping your borrowing under control.

- Smart credit card usage: Not maxing out cards frequently.

A negative report, like a Special Attention Account, can make loan approval tougher. But different lenders have different criteria, so a rejection from one doesn’t mean all doors are closed.

CCRIS vs. other credit reports

CCRIS is like a single ingredient in a recipe. Credit reporting agencies like CTOS use CCRIS data along with other information, like court records and business interests, to create their own credit scores.

FAQ

- Can a bank retrieve the credit report of a borrower who isn’t their client/potential client? Absolutely not! If any bank were to unlawfully attempt to do so, it can be subject to severe penalties under the Central Bank of Malaysia Act 2009.

- Am I able to retrieve my credit report over the phone from BNM? As there’s no way for BNM to verify the authenticity of the caller, and the financial information contained in the report is confidential, BNM is not allowed to do so.

- Am I able to retrieve my credit report from my bank then? Again, that’s a no. You can only get it from BNM or eCCRIS.

- Can I authorize a representative to collect my credit report for me? Nope, the credit report will only be released to the owner of the information. Vice versa, you won’t be able to collect it for anyone else, no matter how close you are! This also applies to any situation where you are/will become the guarantor of a loan. Similarly, if you’re the borrower of a loan and you want to see your guarantor’s credit report, it’s still a no!

- As a Director of a company, can I retrieve the company’s credit report? Yes, you may. You’d need to fill in a Credit Report Request Form, and submit it with a copy of the following documents:

- A copy of identity card (MyKad) or passport (if you are a non-Malaysian) of the authorized person.

- An authorization letter from the company (on company letterhead) to authorise the person to collect the credit report. The letter should be signed by the company secretary and a minimum of two Directors of the company.

- A dated certified true copy of the Company Registration Certificate (Form 9) by company secretary.

- A dated certified true copy of the Company Registration Certificate of Change Name of Company (Form 13) by company secretary (if applicable).

- A dated certified true copy of the latest List of Directorship of Company (Form 49) by company secretary.

- The letter of authorization and certified true copies must be dated within 14 working days before the submission date of your request.

- If my application has been rejected, does that mean BNM has blacklisted me? Not at all! As BNM merely plays the part of a neutral information provider, when one of your applications get rejected, any information of it will not be in your credit report. This is to ensure that a participating financial institution will not be prejudiced by the decision of another participating financial institution. They’ll usually do background checks on the individual, which not only involves CCRIS, but information from other credit reporting agencies such as CTOS Data Systems Sdn Bhd (CTOS), and RAM Credit Information Sdn Bhd (RAMCI).

- If I’ve paid off my loan in full, how come it’s not reflected in my record? Your bank is responsible for updating your record, not BNM. If you notice it, contact your bank to clarify the matter. Additionally, please note that your records will be updated by the next reporting date, i.e. not later than 10th of the following month.

- My loan is reported under a Special Attention Account, what’s that? A Special Attention Account happens when you have any outstanding credit facilities — loans being one of them, but other plausible causes include bounced or dishonored cheques, or special debt management schedules negotiated by AKPK. When your loan is under a Special Attention Account, it means that the financial institution is keeping a very watchful eye on it, until the loan is resolved. Until the loan is recovered, the financial institution is not allowed to lend you any money. To resolve this, contact your financial institution on how to proceed and settle the loan as soon as possible.

- If I was declared bankrupt before, but have now managed to settle all my debts, can BNM remove my name from the bankruptcy status list? Please liaise with the Malaysian Insolvency Department at 03-88851000 on your bankruptcy status and inform the financial institution of the latest status so that it may be reflected in the credit report.

By understanding CCRIS and maintaining a healthy credit history, you can navigate the financial world with confidence and unlock opportunities like buying your dream home. Remember, knowledge is power, and your CCRIS report is a valuable tool to help you achieve your financial goals.

Additional notes:

- This summary is based on the provided information and may not cover everything.

- For the latest details and specific inquiries, visit the official BNM website or contact the relevant authorities.