On April 2, 2025, U.S. President Donald Trump unveiled a comprehensive tariff strategy, termed the “Liberation Day” tariffs, imposing a baseline 10% duty on all imports and significantly higher rates on specific countries, including several Southeast Asian nations. This move has raised concerns about its potential impact on Malaysia’s economy, particularly its key export sectors.

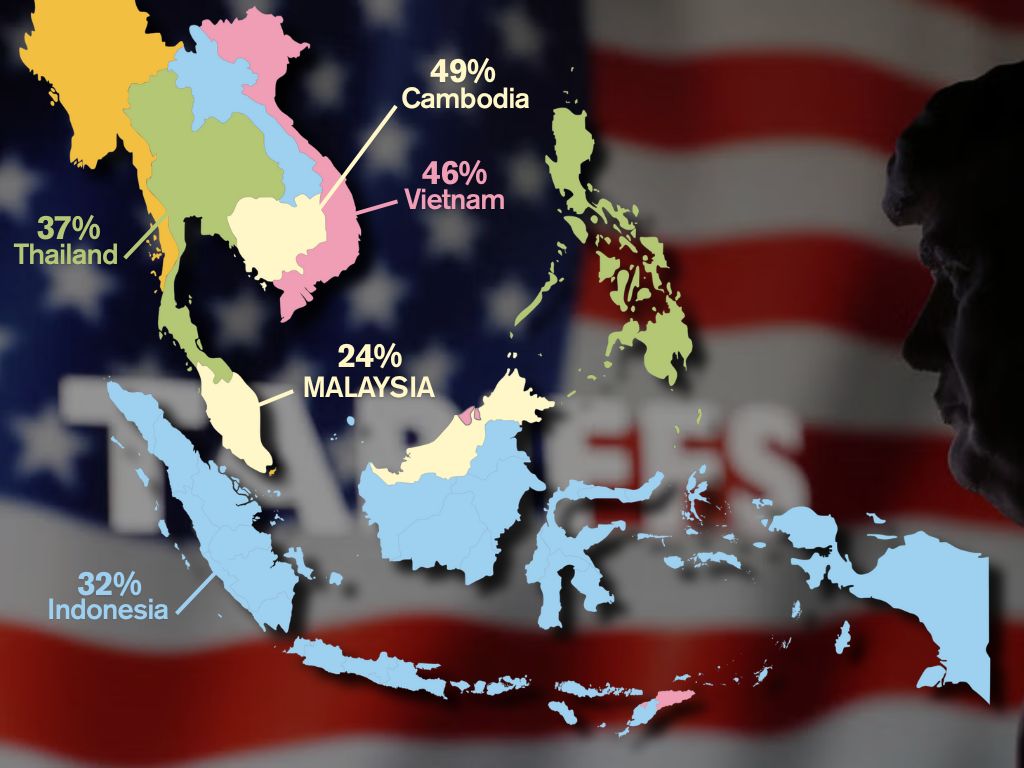

Overview of Tariffs Imposed on Southeast Asian Countries

The tariff rates for Southeast Asian nations are notably higher than those for many other regions. Cambodia faces the steepest tariff at 49%, followed by Vietnam at 46%, Thailand at 37%, and Indonesia at 32%. Malaysia has been subjected to a 24% tariff, effective April 9, 2025. In contrast, the European Union faces a 20% tariff, and Japan 24%. These elevated tariffs could have significant repercussions for the export-driven economies of Southeast Asia.

Malaysia’s Key Export Sectors Affected

Several of Malaysia’s primary export sectors are expected to be impacted by the 24% tariff:

Electronics and Electrical (E&E) Products

Malaysia’s E&E sector, encompassing integrated circuits and components for electronic goods, is a cornerstone of its exports, valued at over RM50 billion in 2024. Notably, semiconductors have been exempted from the tariffs, offering some relief to this critical industry.

Machinery, Equipment, and Parts

This category includes automatic data processing machines, printing machines, and air conditioning units. In 2024, exports in this sector were estimated at US$6 billion (approximately RM27 billion). The new tariffs could make these products less competitive in the U.S. market.

Medical Devices and Optical Instruments

Exports such as medical, dental, surgical, and veterinary instruments were valued at US$3.89 billion (around RM17.5 billion) in 2024. The increased tariffs may affect the profitability and market share of Malaysian manufacturers in the U.S.

Rubber Products

Malaysia exports various rubber products, including surgical gloves and rubber tubes, with an export value of US$1.6 billion (around RM7.6 billion) in 2024. The tariffs could impact the competitiveness of these products in the U.S. market.

Furniture and Lighting

This sector, which includes lamps, lighting fittings, and prefabricated building materials, had exports estimated at US$1.55 billion (about RM7 billion) in 2024. The tariffs may lead to reduced demand from U.S. buyers.

Potential Impact on Malaysia’s Economy and Investment

The imposition of a 24% tariff by the U.S. poses several challenges for Malaysia’s economy:

- Trade Balance: The U.S. is a significant trading partner for Malaysia. Higher tariffs could reduce export volumes, potentially widening Malaysia’s trade deficit.

- Foreign Direct Investment (FDI): Increased tariffs may deter U.S. companies from investing in Malaysia’s manufacturing sector, affecting job creation and economic growth.

- Supply Chain Disruptions: Companies that rely on Malaysian components may seek alternative suppliers to avoid tariffs, disrupting existing supply chains.

Implications for the Real Estate Sector

The 24% U.S. tariff on Malaysian imports could have wide-ranging effects on the country’s real estate market, particularly in the industrial, commercial, and residential sectors. While the impact will not be immediate, over time, shifts in trade dynamics and business sentiment could influence property demand, rental yields, and investment confidence.

Industrial Properties: Pressure on Manufacturing Hubs & Warehouses

Malaysia’s export-driven economy relies heavily on manufacturing zones such as Penang, Selangor, and Johor, which house key industries like electronics, machinery, and medical devices. A drop in U.S. demand could lead to:

- Lower occupancy rates in industrial parks and logistics hubs, particularly in areas catering to U.S.-bound exports.

- Weaker demand for new industrial developments, slowing down future projects.

- Reduced foreign direct investment (FDI) from U.S. manufacturers, as companies may shift their supply chains elsewhere to avoid tariffs.

However, regional demand from China, India, and ASEAN markets could help cushion some of the impact. If Malaysian manufacturers diversify their export markets, it may mitigate the decline in industrial property demand.

Commercial Real Estate: Office & Retail Challenges

Businesses that rely on exports to the U.S. – particularly in manufacturing, logistics, and trading – may adjust their expansion plans or scale back operations, leading to:

Office Market

- Weaker demand for office spaces, especially for companies in trade-dependent industries.

- Delayed expansion or relocation plans by multinational firms due to economic uncertainty.

- Higher vacancy rates in commercial hubs like Kuala Lumpur’s central business district (CBD) and industrial zones in Shah Alam, Klang, and Johor.

Some companies may restructure by downsizing to smaller office spaces or shifting to flexible workspaces to cut costs.

Retail Sector

- Potential decline in consumer spending, as job losses or wage stagnation could affect retail sales.

- Retail property owners may struggle with rental negotiations, as businesses look to reduce operating costs.

- Shopping malls in business-heavy districts might experience slower foot traffic if commercial activity weakens.

However, sectors like e-commerce, logistics, and warehousing may see sustained demand, offering new opportunities for commercial property owners.

Potential Silver Linings: What Could Offset the Impact?

Despite these challenges, certain factors could cushion the real estate sector from a sharp downturn:

✅ Government Interventions – Policies such as incentives for foreign investors, tax breaks for manufacturers, and initiatives to strengthen domestic demand could sustain business confidence.

✅ Diversification of Export Markets – Malaysia could pivot towards ASEAN, China, India, and the Middle East to reduce reliance on the U.S., preventing drastic industrial slowdowns.

✅ Growth in Other Sectors – Data centers, green technology, digital economy industries, and logistics could continue attracting commercial real estate investments.

✅ MM2H & Foreign Buyers – If Malaysia relaxes its MM2H (Malaysia My Second Home) policies, this could attract foreign property buyers, counterbalancing the local slowdown.

Final Thoughts

While the U.S. tariffs pose a risk to Malaysia’s economy and its real estate market, the extent of the impact will depend on how businesses adapt and whether the government introduces support measures. In the short term, industrial and commercial real estate may feel the effects first, followed by residential properties in affected job sectors.

However, diversification of trade markets, local business resilience, and strategic government interventions could help stabilize the property sector, preventing a long-term downturn.

Sources:

- Reuters. (2025, April 3). Southeast Asia nations hit particularly hard by U.S. tariffs, prepare talks with Trump. Retrieved from Reuters

- Free Malaysia Today. (2025, April 3). Malaysia hit with 24% reciprocal tariff by the U.S. Retrieved from Free Malaysia Today

- New Straits Times. (2025, April 3). U.S. imposes 24% retaliatory tariff on Malaysian imports: Watch. Retrieved from New Straits Times

- The Edge Malaysia. (2025, April 3). U.S. tariffs on Malaysian exports: What it means for the economy. Retrieved from The Edge Malaysia

- Malay Mail. (2025, April 3). Chips, machines, gloves: Which Malaysian exports will be hit hardest by Trump’s Liberation Day tariffs? Retrieved from Malay Mail

Disclaimer:

MyPropertyPlaces.com does not provide professional advice, and readers should seek independent advice from qualified experts before making any financial, real estate, or investment decisions. MyPropertyPlaces.com is not responsible for any direct or indirect losses or damages arising from the use of or reliance on the content found on this website.