Saving for a home can feel overwhelming, but with a solid strategy and consistent effort, you can successfully build your Dream Home Fund. Whether you’re buying your first home, upgrading, or investing in property, this guide will walk you through the steps to help you save effectively for your future home. Let’s dive into the details that will empower you to turn your dream into reality.

Step 1: Establishing Your Dream Home Vision

Before starting your savings journey, it’s important to have a clear Dream Home Vision in mind. This will not only serve as your motivation but also help you stay focused. Ask yourself the following questions:

- What type of property are you aiming for (e.g., condo, semi-detached house, apartment)?

- Where would you like it to be located?

- What is the estimated cost of the property, including taxes and fees?

Once you have these specifics, you’ll know how much you need to save. This gives you a tangible target and will make the process of building your Dream Home Fund much clearer.

Step 2: Assessing Your Current Finances

Start by taking a deep dive into your financial situation. Here’s how to get started:

- Analyze your income: List all sources of income, including your primary salary, side gigs, or passive income streams.

- Calculate your monthly expenses: Break these into fixed costs (rent, utilities, insurance) and variable costs (groceries, dining out, entertainment).

- Review your existing savings and debt: Take stock of your current savings and any outstanding loans or credit card debt. This will give you an accurate picture of your financial standing.

The goal here is to identify how much disposable income you have each month and determine how much you can reasonably allocate to your Dream Home Fund.

Step 3: Crafting a Realistic Budget

Your budget is the roadmap to your savings success. Here’s how to create a budget that works:

- List your monthly income.

- Subtract fixed expenses: These include rent, transportation, utilities, and loan repayments.

- Plan for discretionary spending: Allocate funds for non-essential expenses like dining out, shopping, and entertainment. Be realistic, but ensure you leave enough room to enjoy your life while saving.

- Set aside savings for emergencies: Don’t forget to build an emergency fund. This is crucial for handling unexpected financial setbacks.

- Allocate a portion to your Dream Home Fund: Aim to contribute at least 20-30% of your monthly disposable income if possible.

Review this budget monthly and make adjustments as needed. The more refined it is, the closer you’ll get to your Dream Home Vision.

Step 4: Maximising Your Savings Potential

Now that you’ve budgeted for your Dream Home Fund, here are some effective strategies to help accelerate your savings:

1. Automate Your Savings

One of the best ways to ensure consistency is to automate your savings. Set up automatic transfers to a separate savings account dedicated to your Dream Home Fund. This way, a portion of your income is tucked away before you even have the chance to spend it.

2. Reduce Non-Essential Spending

Take a hard look at your discretionary expenses. Could you reduce how often you eat out or how many streaming services you subscribe to? Small cuts in these areas can add up over time and contribute significantly to your savings.

3. Increase Your Income

If your current income isn’t enough to save the desired amount, consider finding ways to earn extra income:

- Start a side hustle, such as freelancing, tutoring, or consulting.

- Take on part-time jobs or gig economy roles that fit your schedule.

- Sell unused or unwanted items online.

Use any additional earnings to boost your Dream Home Fund. Even small streams of extra income can make a big difference over time.

Step 5: Prioritising an Emergency Fund

While building your Dream Home Fund, don’t neglect your emergency fund. Aim to set aside three to six months’ worth of living expenses in a liquid, easily accessible account. An emergency fund will safeguard you against unforeseen expenses and prevent you from dipping into your savings when an unexpected situation arises.

Step 6: Exploring Financial Assistance Programs

Many governments and local institutions offer financial assistance to homebuyers. Research grants, subsidies, and low-interest loan programs available in your area. These can significantly ease the financial load and help you meet your savings target faster. Look out for programs specifically designed for first-time buyers, which often offer attractive incentives.

Step 7: Tracking Your Progress

Set regular intervals (e.g., monthly or quarterly) to review your savings progress. Ask yourself:

- How close are you to your Dream Home Fund goal?

- Are there areas where you can cut back further or earn more?

- Is your current budget still realistic?

Celebrate your progress when you hit key milestones. Positive reinforcement will keep you motivated, and periodic adjustments will keep you on track.

Saving for a home is a journey that requires discipline, planning, and smart financial choices. By setting your Dream Home Vision, creating a personalised budget, and implementing effective savings strategies, you’ll steadily build your Dream Home Fund. Always prioritise having an emergency fund, explore all available financial programs, and consider investing if you have a longer time horizon. With commitment and perseverance, your dream of homeownership will be within reach.

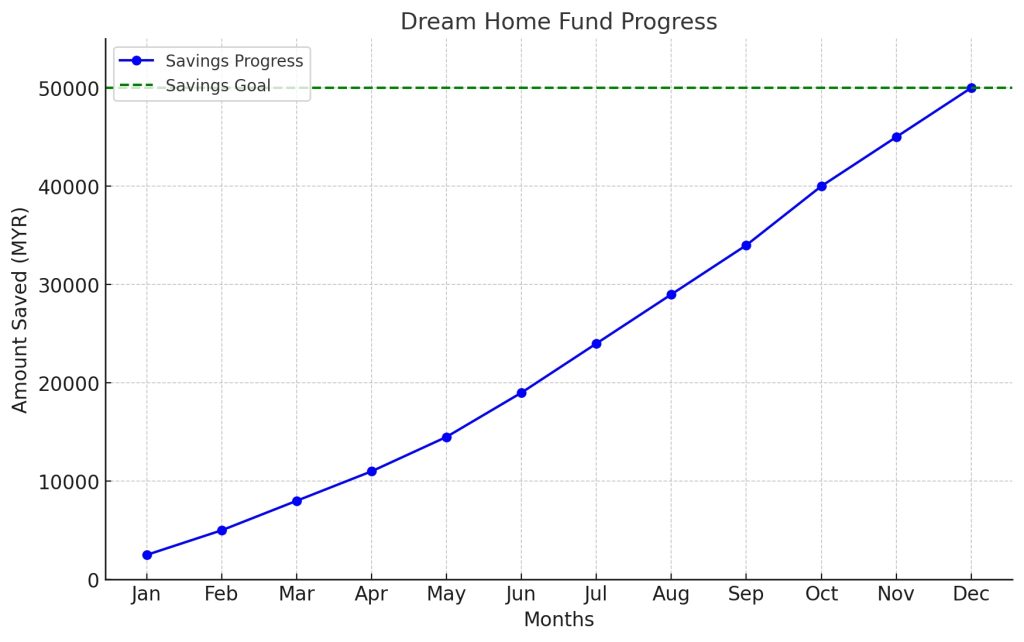

Here’s a sample chart to help track your progress toward your Dream Home Vision. The blue line represents your monthly savings progress, while the green dashed line shows your overall savings goal. Use this visual to monitor your journey and adjust your strategies as needed to stay on track!

Case Study: How Jane Saved for Her First Home

Jane, a 28-year-old marketing executive, dreamed of owning a RM500,000 condo in Petaling Jaya. She set a goal to save RM100,000 (20% down payment + fees) within 5 years. Here’s how she did it:

- Budgeting & Cutting Expenses:

- Reduced dining out from RM800 to RM400 per month.

- Canceled an unused gym membership, saving RM150 monthly.

- Allocated RM1,500/month toward her Dream Home Fund.

- Increasing Income:

- Took up freelance writing, earning an extra RM1,000/month.

- Sold unused electronics and clothes, adding a one-time RM3,000 to her savings.

- Smart Savings Strategy:

- Invested RM20,000 in a Fixed Deposit (FD) at 3.5% annual interest for additional passive income.

By staying disciplined, Jane reached her goal 6 months ahead of schedule, moving into her dream home in Year 5!

Simple Savings Tracker (Monthly Progress Chart)

| Month | Monthly Savings (RM) | Total Savings (RM) |

|---|---|---|

| Jan | 2,000 | 2,000 |

| Feb | 2,000 | 4,000 |

| Mar | 2,500 | 6,500 |

| Apr | 3,000 | 9,500 |

| … | … | … |

| Year 5 | (Final Month) | 100,000+ |

Disclaimer:

The information provided in this article by Mypropertyplaces.com is intended for general informational purposes only and does not constitute financial, legal, or investment advice. While we strive to ensure the content is accurate and up-to-date, Mypropertyplaces.com makes no warranties or representations regarding the completeness, reliability, or suitability of the information for your specific situation. Readers are advised to consult with a licensed financial advisor or professional before making any decisions related to saving, investing, or homeownership. Investments come with risks, and past performance is not indicative of future results. Mypropertyplaces.com will not be held liable for any losses or damages arising from the use of this information. Always seek personalized advice for your financial needs.