Now that you’ve successfully secured a housing loan, signed the deal, received the keys, and made the necessary renovations, it’s time to settle into your new home. However, there’s one important aspect you can’t overlook: taxes.

Like in many countries, taxes are a crucial source of revenue for the government to fund various national initiatives and keep the country running smoothly. While property-related taxes can vary in terms of their structure, purpose, and implementation, this article will provide a comprehensive overview of Quit Rent (Cukai Tanah) in Malaysia.

Quit Rent: A Must-Know for Property Owners

If you own a piece of land or property in Malaysia, understanding Quit Rent (Cukai Tanah) is essential. It’s a mandatory annual tax imposed by the state government on your ownership of land or property.

The primary legal frameworks governing Quit Rent are the National Land Code (1965) and the individual state land rules. These laws empower the state government to regulate land-related matters, including the collection of Quit Rent.

Failure to pay Quit Rent within the specified timeframe can result in legal consequences. Therefore, it’s crucial to fulfil your legal obligation as a property owner.

Quit Rent Due Date

Quit Rent is an annual tax that must be paid once a year. The billing period typically runs from January 1st to May 31st. The due date for Quit Rent is usually May 31st of each year, as specified in Section 94(2) of the National Land Code (1965). If not paid by the due date, it will be considered overdue.

Ignoring Quit Rent: A Risky Move

Failing to pay Quit Rent can have serious consequences. The state government may impose late payment penalties based on the number of days the payment is overdue, as outlined in the State’s Land Rules.

According to the National Land Code (1965), Quit Rent defaulters face harsh penalties and punishments for missed payments. These penalties can include:

- Notices and Fines: First-time defaulters may receive notices and fines as a warning.

- Restrictions on Property Transactions: Unpaid Quit Rent can restrict property transactions, such as subdivision, development, transfer, lease, or mortgage.

- Arrest Warrants: Persistent defaulters may face arrest warrants, resulting in a 10% increase in the outstanding tax amount.

- Property Seizure: In severe cases, the state government may seize the land and any property associated with the overdue Quit Rent. This can lead to property auctions.

While property seizure is a serious measure, it’s important to note that the state government carefully assesses various factors before taking such action.

In 2019, the Pahang state government issued a warning to Quit Rent defaulters, indicating that their land might be seized if the tax had been unpaid for more than five years. However, those facing genuine financial hardship may be exempt from land forfeiture.

Quit Rent Calculation Made Easy

As a property owner, you don’t have to worry about calculating Quit Rent yourself. The state government will provide you with the exact amount due.

Here’s a basic breakdown of how Quit Rent is calculated:

- Land Size: The total area of your land is used to determine the taxable amount.

- Rate: The rate varies based on factors like state, property type, and location. Urban areas generally have higher rates than rural areas.

- Calculation: Multiply the land size by the applicable rate to get the total Quit Rent.

For example, if your property is 1800 square feet and the rate is RM0.035 per square foot, your Quit Rent would be RM63.00.

It’s important to note that Quit Rent rates can change over time. Additionally, some states, like Sarawak, have abolished Quit Rent or provided exemptions for certain property types and land sizes.

Checking Your Quit Rent Online

To check your Quit Rent status, you can visit the official website of the Land and Mines Office (Pejabat Tanah dan Galian, PTG) in your state. The website address varies by state, for example, if your property is in Kuala Lumpur, you would look for the PTGWP website.

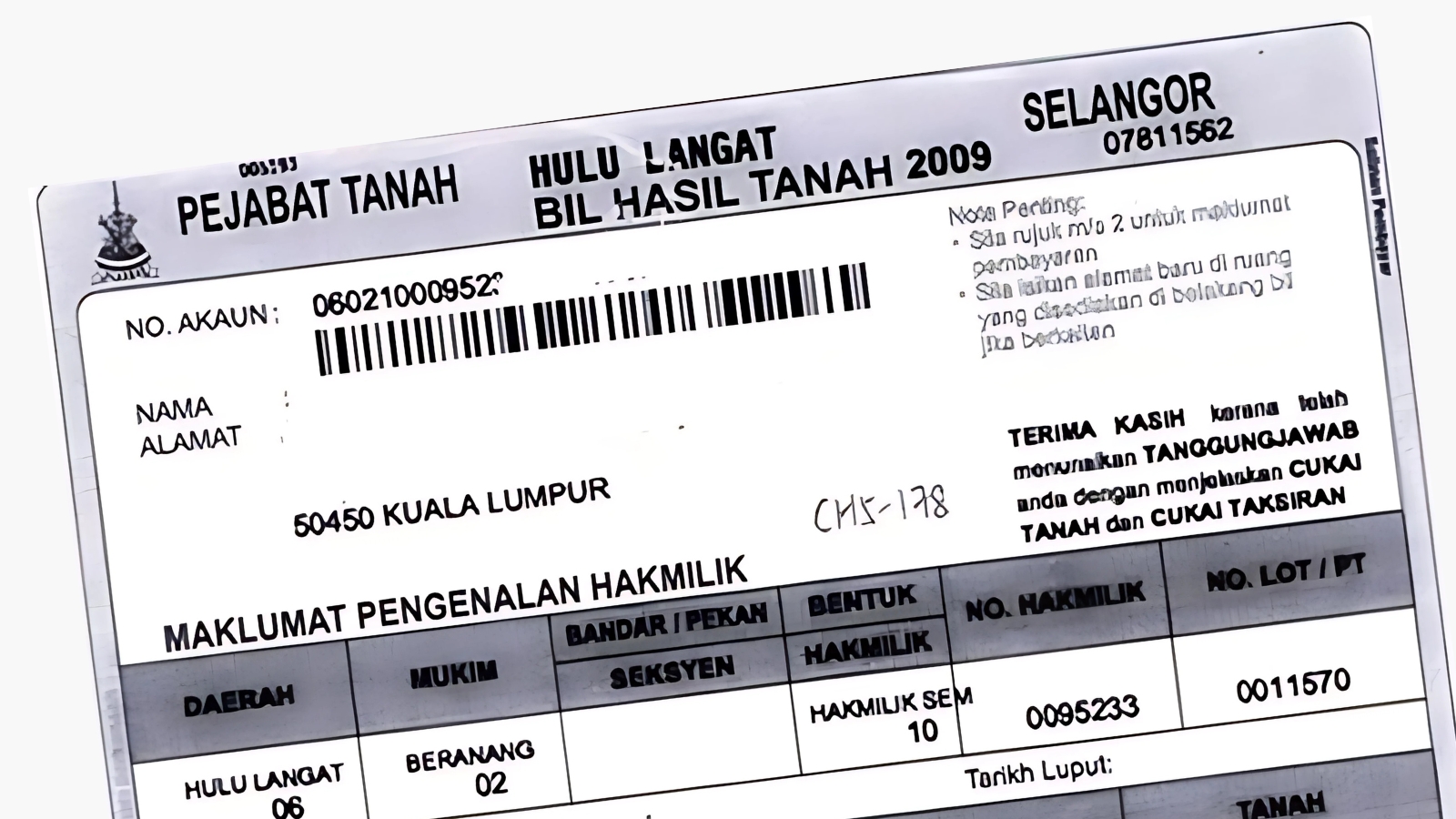

To check your Quit Rent, you’ll need your account number or lot number, which can be found on previous Quit Rent bills. If you haven’t received any bills, you can register online on the state website to obtain this information. Refer to the Johor or Pahang Land and Mines Office websites for examples.

Paying Quit Rent: Convenient Options Available

You can pay your Quit Rent (Cukai Tanah) at the headquarters or branches of the Land and Mines Office (Pejabat Tanah Galian). In some states, you may also pay at local councils, district offices, or even post offices.

Many PTGs offer online payment options, either through their own portals or internet banking. Pos Online accepts Quit Rent payments in Selangor, Perak, Kuala Lumpur, Melaka, Putrajaya, and Negeri Sembilan.

Here are some apps and online portals that can be used to pay quit rent in Malaysia:

- ehasil.selangor.gov.my The online payment portal for Selangor that allows users to pay quit rent online

- Pos Online A website that allows users to pay quit rent, phone and internet bills, and utilities bills

- Cepat A mobile app that allows users to pay quit rent, as well as other local council and state agency transactions

- MyPTGNS An app that allows users to make transactions and access public services, including quit rent

- eCUKAI@MBPJ Mobile Apps A mobile app that allows users to pay and manage assessment tax

Paying Quit Rent Online

Paying your Quit Rent online is a quick and easy alternative to traditional methods. Here’s how to do it:

General Online Payment via Internet Banking (Most PTGs):

- Check Supported Banks: Each PTG website lists the banks authorized for online Quit Rent payment. Visit your state’s PTG website to confirm their partnered banks.

- Log in to Your Online Banking: Once you’ve verified the supported banks, access your online banking account for the listed bank.

- Make the Payment: During the bill payment process, select “Pejabat Tanah & Galian [Your State]” as the payee.

- Complete the Transaction: Follow your bank’s instructions to complete the online payment.

Note: Some PTGs may charge a processing fee for online payments using credit cards.

Specific Example: Paying Quit Rent Online in Selangor

The Selangor PTG offers an online portal for Quit Rent payments:

- Access the Portal: Go to the Selangor PTG online payment portal at ehasil.selangor.gov.my (not ezhasil, the income tax portal).

- Find Your Account: Under the “eSemakan” (electronic search) section, enter your account number or title number (found on a previous bill) to search for your account and outstanding amount.

- Verify and Pay: If the details are correct, your account details will be displayed. If you have a payment due, a “Bayar” (pay) button will appear next to the amount.

- Choose Payment Method: Click “Bayar” and select your preferred payment method – FPX or credit card.

- Complete Payment:

- FPX: Log in to your online banking with a supported bank (Maybank, Public Bank, or CIMB) to authenticate and complete the payment.

- Credit Card: Enter your credit card details and the one-time password (OTP) sent to your phone to finalize the payment.

- Record Keeping: Print or save the payment transaction receipt and Quit Rent receipt for your records.

Additional Options:

- State-specific portals: Some states, like Johor, have their own online payment portals (e.g., JohorPay). Visit the respective PTG website for details.

- Mobile Apps: Several PTGs offer mobile applications for convenient access to payments and other services. Check the PTG website in your state for availability.

By following these steps and exploring your state’s PTG website, you can easily pay your Quit Rent online, saving time and resources.

Responsibilities of a Property Owner

In addition to paying Quit Rent, property owners have other responsibilities:

- Update Contact Information: Notify your local council of any changes to your postal address.

- Report Ownership Changes: Inform your local council of any changes in property ownership. Submit a written notification or use Form F (available at the council’s office) and provide a copy of the Memorandum of Transfer (MOT) or Sales and Purchase Agreement.

- Check for Outstanding Payments: Before a change of ownership, verify with your local council if there are any outstanding property taxes. Settle any unpaid amounts.

Leave a Reply