What is CCRIS?

CCRIS (Central Credit Reference Information System) is a record kept by Bank Negara Malaysia that acquires and tracks your loan repayment behavior.

The CCRIS report includes:

- Intensive details of all the loans you have with every financial institution in Malaysia (this covers all the banks and non-bank financial institutions like AEON Credit or PTPTN)

- Loan repayment history over the past 12 months including any overdue

- ‘Special Attention’ loan or loan under close monitoring by the banks

- Any loan that has been rescheduled or restructured

How To Read CCRIS Report?

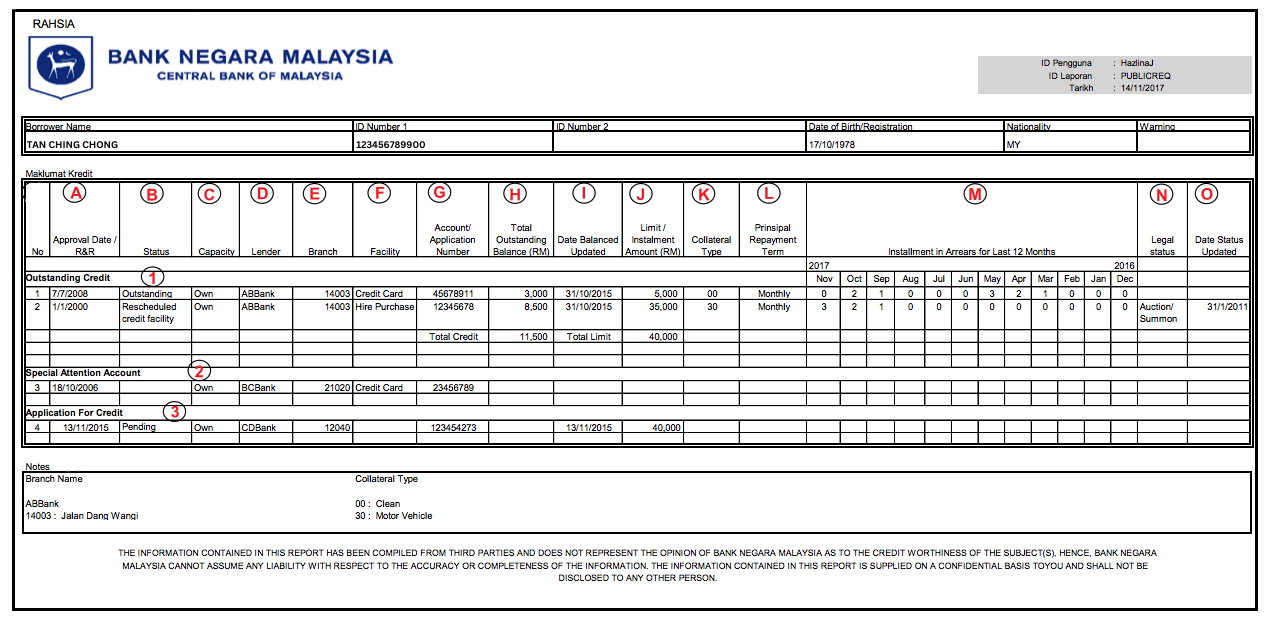

Tan Ching Chong currently holds two active credit facilities, as indicated in the outstanding credit report. One is a credit card, while the other is a hire purchase agreement for a vehicle. The hire purchase loan was initiated in January 2000, with an initial loan amount of RM35,000. Presently, there remains an outstanding balance of RM8,500 on this loan.

In July 2008, Tan Ching Chong acquired a credit card facility with a credit limit of RM5,000. As of the current period, the total outstanding balance on the credit card amounts to RM3,000.

Tan likely faced challenges in maintaining timely payments for her car loan, leading to inconsistencies in payment for several months. Consequently, she received a summons on January 31, 2011, as indicated in the “N” column under Legal Status. In response, she opted to restructure her payment plan once more, aiming to extend the duration of her loan tenure, as reflected in the “B” column under Status.

Reviewing the table, it’s evident that Tan maintained consistent payments towards her car loan from December 2016 to August 2017. This is indicated by the absence of any entries denoting missed payments or arrears, as denoted by “0.” However, starting from September 2017, there is a noticeable gap in payments, spanning three months of instalments, as indicated in the November column.

Here’s a reference tip:

| CCRIS Reference Tip | |

|---|---|

| 0 | No missed payments / arrears |

| 1 | Late payment for 1 month |

| 2 | Late payment for 2 months |

| 3 | Late payment for 3 months |

Credit card report analysis of Tan

Analyzing Tan’s credit card record, it’s evident that she generally made consistent monthly instalment payments, with occasional lapses. Specifically, she missed payments for three consecutive months from March 2017 to May 2017. Additionally, Tan was two months late in making payments during September and October 2017.

Tan’s credit card, which she applied for in October 2006, is categorized under the “Special Attention Account” (SAA). This classification suggests that there may have been instances where Tan missed her monthly payments for more than three months, resulting in her inclusion in the SAA category.

So, you may notice that Tan has applied for a credit card facility on November 2015 and it is currently pending. In your opinion, do you think Tan’s credit card would be approved?

Below is the explanatory description for each credit information label:

(1) Outstanding Credit – This section displays the facilities that the borrower has taken.

(2) Special Attention Account (SAA) – Those that fall under this category shows outstanding credit facility under close supervision by the financial institution.

(3) Application for Credit – This section displays the approved or pending credit applications that are made over the last 12 months.

A – Approval Date / R&R – The application date when the credit facility has been approved

B – Status – This indicates the credit status for applications. For example: Outstanding (All outstanding credits obtained by the borrower), Rescheduled Credit Facility (The original payment schedule of the credit facility has been rescheduled), Facility restructured under AKPK

C – Capacity – Description of the credit facility obtained by the borrower is under his own name, joint name with another individual, name under sole proprietorship and partnership or professional body

D – Lender – Financial institution that disbursed the credit facility

E – Branch – The credit facility that was applied at

F – Facility – The type of credit facility i.e. personal loan, credit card, housing loan, etc.

G – Account/ Application Number – The reference number assigned by the financial institution for the credit facility

H – Total Outstanding Balance – The reference outstanding amount of the credit facility

I – Date Balanced Updated – The total outstanding amount of the facility

J – Limit/ Instalment Amount – The total amount approved by the financial institution or contractual obligation amount to be repaid by borrower until the total amount is settled

K – Collateral – The type of collateral or security for the credit facility

L – Principal Repayment Term – The frequency of each credit facility’s payment

M – Instalment in Arrears for Last 12 months – Refers to payment records of the credit facility. Example: 0 (no late payment), 1 (1 month in arrears), 2 (2 months in arrears) and so on

N – Legal Status – The legal action taken against the borrower because of defaulted payments

O – Date Status Updated – The latest date of the legal action status

How a Bank sees CCRIS report

When applying for a bank loan, whether it’s a mortgage or a personal loan, the bank typically reviews your CCRIS record to evaluate your historical repayment behavior. While each bank may employ varying credit criteria, consistently missing loan payments for 2-3 months within the past 6 months or having a loan classified under ‘Special Attention’ could be viewed unfavorably and potentially impact the approval of your loan application.

For Co-operative or koperasi loan (pinjaman koperasi), given the repayments is via direct salary deduction, the chances of your application being approved is higher although you may be 2-3 months overdue on your outstanding payments.

The Central Credit Reference Information System (CCRIS) provides a concise overview of all your credit and loan obligations with the bank. It serves as a tool for the bank to evaluate your eligibility for loans.

Through the CCRIS report, you can monitor your payment history with the bank. Consistently paying before the due date results in a ‘0’ notation each month, indicating timely payments. Conversely, if you make payments after the due date, the report will display a ‘1’ to indicate one month of late payment, ‘2’ for two months, and so forth.

Basic information about CCRIS we all should know

The Credit Bureau of Bank Negara Malaysia oversees the Central Credit Reference Information (CCRIS), which generates credit reports. CCRIS is responsible for gathering credit-related data on borrowers from various participating financial institutions across Malaysia. These entities encompass individuals, businesses (including sole proprietors, partnerships, and companies), professional bodies, associations, societies, and government entities.

Participating financial institutions include licensed commercial banks, Islamic banks, investment banks, development financial institutions, as well as various other entities such as insurance companies, payment instrument issuers, rehabilitation companies, building societies, credit leasing companies, and government agencies.

Financial institutions’ updates on regular basis

Participating financial institutions are mandated to regularly report the following information:

- Borrower profile details, including name, identity card or business registration number, date of birth or registration, address, and other relevant information.

- Credit application specifics, such as the applied amount, application date, and type of facility requested.

- Credit account particulars, such as types of credit facilities, credit limits, outstanding balances, installment amounts, account behavior, and any legal actions taken, if applicable.

This compiled data is utilized to generate a comprehensive credit report accessible to financial institutions such as banks. The information on the credit report is typically segmented into a 12-month timeframe.

The major stats mentioned in CCRIS

The CCRIS credit report comprehensively details the following aspects of the borrower:

- Outstanding Credit: This includes all active credit facilities obtained by the borrower under their name, joint names, sole proprietorship, partnership where the borrower is the owner, or professional body where the borrower is a member.

- Special Attention Account(s): These are outstanding credit facilities closely monitored by participating financial institutions.

- Application(s) for Credit: This section encompasses all approved applications within the past 12 months and pending applications for the borrower.

It’s important to note that CCRIS doesn’t solely contain negative credit information but also reflects positive data such as credit approvals and a positive repayment history. Contrary to common misconceptions, CCRIS does not blacklist individuals based on repayment patterns. Instead, it presents factual data for use by financial institutions. Additionally, credit facilities that have been fully settled are excluded from the credit report.