Securing a loan can be a complex and time-consuming task. When it comes to getting your loan approved, one crucial factor that holds significant weight is your debt service ratio (DSR). It’s essential to understand what DSR is and how it can affect your loan approval. Lenders consider various aspects, including your credit history and occupation, in addition to your DSR, to assess your creditworthiness. By ensuring a favorable DSR, you can demonstrate to loan officers that you are financially reliable.

But what is debt service ratio (DSR), and how it can affect the loan approval?

If you’ve ever applied for a loan, such as a car, home, or personal loan, you’ve likely come across the term “debt service ratio” mentioned by the loan officers at the bank. But what exactly does it mean?

The debt service ratio, commonly known as DSR, is a calculation used by banks to assess your ability to repay the loan. It compares your current debt obligations to your income. The goal is to determine whether you have sufficient income to cover your existing debts along with the additional loan you’re applying for.

Lenders have a maximum allowable DSR limit, and if your DSR falls within that limit, your chances of loan approval increase. Generally, a lower DSR is favorable and improves your likelihood of getting approved for a loan. It is advisable to maintain your DSR within the range of 30-40% for the best results.

Do take note that a DSR limit varies according to individuals and their respective levels of net income.

How is Debt Service Ratio calculated?

Knowing your Debt Service Ratio (DSR) is crucial before applying for a property loan in Malaysia. It helps you understand your borrowing capacity and increases your chances of loan approval. Let’s dive into how you can calculate your DSR:

Step 1: Gather Your Information

- Monthly Net Income: This is your income after deducting taxes, EPF contributions, and SOCSO. Include payslips, tax returns, and other income sources (rental income, dividends, etc.).

- Monthly Debt Commitments: List all your existing debt obligations, including:

- Car loans

- Credit card bills

- Personal loans

- PTPTN repayments

- Other ongoing installments

- Estimated monthly property loan payment (based on desired loan amount and interest rate)

Step 2: Calculate Your Total Debt Commitments

Add up all your monthly debt commitments, including the estimated property loan payment. This will give you your Total Monthly Debt.

Step 3: Apply the DSR Formula:

DSR = (Total Monthly Debt / Monthly Net Income) x 100

Step 4: Interpret Your DSR:

- DSR below 50%: Excellent! This indicates low debt and a high loan approval chance.

- DSR between 50% and 70%: Good, but some banks might require justifications or stricter lending terms.

- DSR above 70%: High risk. Loan approval is unlikely unless you have exceptional creditworthiness or substantial income.

Tips:

- Use realistic estimates for your property loan payment based on current interest rates and desired loan amount.

- Include all debt commitments, even small ones, for an accurate picture.

- Consider using online DSR calculators for convenience.

- Remember, different banks have varying DSR limits. Research their specific requirements before applying.

Additional Information:

- Some banks might consider other factors like credit score and employment stability alongside DSR.

- Consult a financial advisor or mortgage broker for personalized guidance and loan options.

- This guide is for informational purposes only and does not constitute financial advice.

Bonus:

- Improve your DSR by reducing existing debt or increasing your income.

- Consider a smaller property or lower loan amount to bring your DSR within acceptable limits.

What can I do to improve my DSR?

- Reduce Your Debt! If you have debt from loans or unpaid debit cards, it is best you clear it up. One of the best ways to start is via the snowball method. Alternatively, you can also consolidate multiple repayments into one loan too, thereby simplifying your repayments into one; it saves on interest too.

- Minimize! Try to reduce the number of loans or credit cards in your name as much as possible. This is especially so if you are one who impulsively spends with a credit card.

- Always Pay On Time! Whenever your bills or credit card statements come, always pay it off 100%. What may seem like an unpaid small amount can stack up with the following months, resulting in a large debt monster.

Any other factors to assess my credit worthiness?

Yes, absolutely! CCRIS and CTOS reports can help bank to assess your credit worthiness.

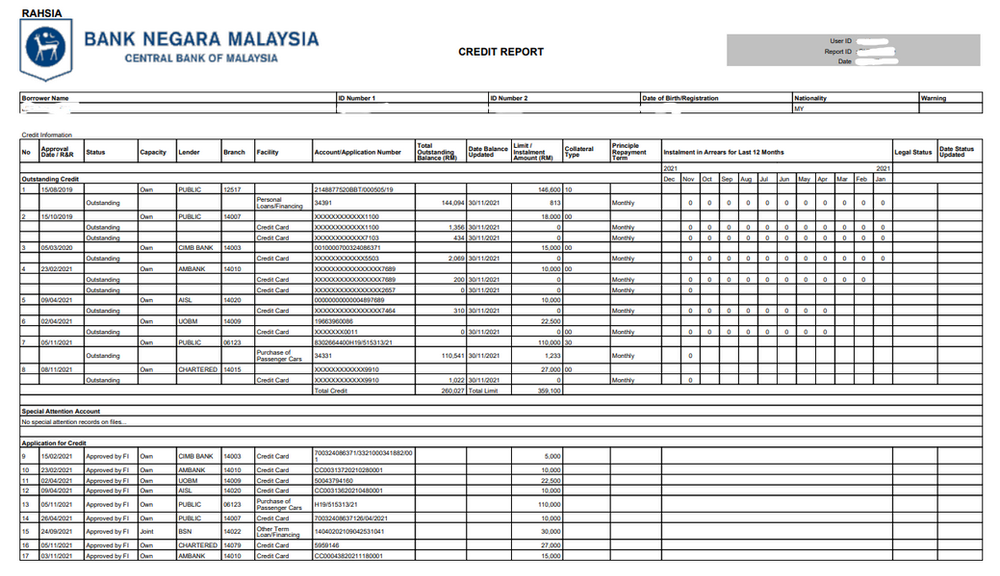

CCRIS report shows your existing outstanding credit and application for credit that you made in the past 12 months, whether it was approved, pending, or rejected by the bank. CCRIS report also shows the capacity of borrowing that you took from the bank, such as sole proprietor, partnership, joint application or acting as guarantor.

CTOS report contains your full credit history, payment behavior, your CTOS score, directorship as well as business interest, litigation and bankruptcy. It is pretty much your credit health and score at a glance.

All being said, it is important to have some good debt to help build your credit score and also to have an excellent debt service ratio. This will make it easier for you when you are applying for financing plans or loans in the future.