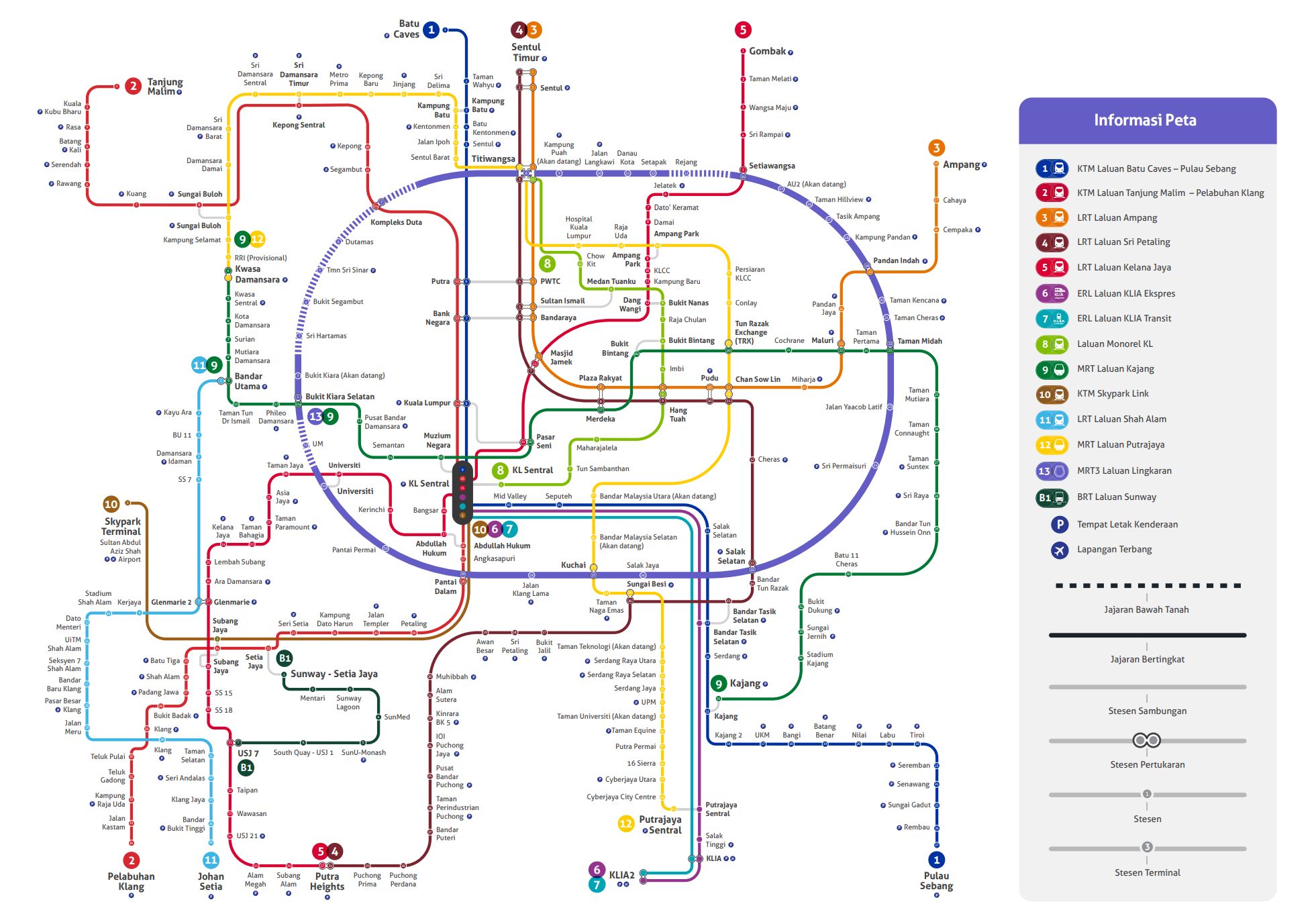

The Klang Valley is set to welcome a new rail line, the MRT 3 Circle Line, which will enhance and integrate with the existing public transport system. In preparation for the project’s launch, MRT Corp has initiated a public inspection period from 2nd September to 2nd December 2024. This allows the public to review and offer feedback on the proposed alignment, site plans, and other important project details.

Understanding the Circle Line’s Impact on Real Estate

The MRT 3 Circle Line is Malaysia’s first circular rail line, spanning 51 km. This loop allows commuters to travel between various parts of the Klang Valley more efficiently, avoiding the need to pass through the center of Kuala Lumpur to switch lines. Completing a full loop takes 73 minutes, with each train capable of carrying up to 750 passengers. The line is designed to handle a capacity of 25,000 passengers per hour in each direction.

The new MRT line will feature 12 km of underground tracks and 39 km of elevated sections. A total of 32 stations are planned, consisting of 22 elevated stations and 7 underground stations, with an additional 3 provisional elevated stations. Here are the proposed alignment as listed in the their microsite.

Investment Hotspots Along the Circle Line

Several locations along the Circle Line stand out as promising real estate investment destinations. Let’s explore some of these hotspots:

- Bukit Kiara South: As an interchange station with the Kajang Line, Bukit Kiara South is well-positioned to benefit from increased connectivity and demand. The surrounding area offers a mix of residential and commercial developments, making it a versatile investment option.

- Dutamas: Located near the affluent neighborhoods of Mont Kiara and Sri Hartamas, Dutamas offers a blend of luxury condominiums and commercial properties. Its proximity to the Circle Line and established amenities make it a sought-after investment destination.

- Titiwangsa: As a major interchange hub connecting the Ampang Line, Sri Petaling Line, KL Monorail, and Putrajaya Line, Titiwangsa is a strategic location. The surrounding area is undergoing rapid development, with new residential and commercial projects emerging.

- Setiawangsa: This established residential neighborhood is set to experience a resurgence with the Circle Line’s arrival. Its proximity to schools, shopping malls, and recreational facilities makes it an attractive option for both investors and homebuyers.

- Taman Midah: Another interchange station with the Kajang Line, Taman Midah is a mature residential area with a strong demand for housing. The Circle Line’s connectivity will further enhance its appeal and investment potential.

- Salak Selatan: As a key interchange station with the Sri Petaling Line and KTM Batu Caves-Pulau Sebang Line, Salak Selatan offers excellent connectivity. The surrounding area is a mix of residential and commercial developments, with opportunities for both short-term and long-term investments.

- Pantai Dalam: This coastal area is poised to benefit from increased tourism and leisure activities with the Circle Line’s arrival. The development of waterfront properties and commercial centers can be expected in the future.

- Universiti: Located near the University of Malaya, Universiti station will cater to students, faculty, and staff. The surrounding area offers a mix of residential and commercial options, with potential for student accommodation and retail developments.

Factors to Consider for Real Estate Investors

When investing in properties along the Circle Line, consider the following factors:

- Property Type: Determine whether you prefer residential, commercial, or mixed-use properties based on your investment goals and risk tolerance.

- Location: Evaluate the specific location within each station area, considering factors such as proximity to amenities, traffic congestion, and future development plans.

- Developer Reputation: Research the developer’s track record and financial stability to assess the project’s viability and potential for appreciation.

- Rental Yield Potential: Consider the rental market dynamics in the area and estimate potential rental yields based on property type and location.

- Capital Appreciation: Assess the long-term growth prospects of the property based on factors such as economic development, infrastructure improvements, and population growth.

- Exit Strategy: Plan your exit strategy, whether it’s selling the property for a profit or holding it for long-term rental income.

Should Homebuyers Buy in These Locations?

The decision of whether to buy a home along the Circle Line depends on individual circumstances and preferences. If you prioritize convenience, accessibility, and potential for future appreciation, these locations offer compelling opportunities. However, it’s essential to conduct thorough research and consider factors such as budget, lifestyle needs, and long-term plans.

Additional Considerations

- Construction Timeline: Keep track of the Circle Line’s construction progress and anticipated completion dates. Delays or changes in the project timeline could impact property values and rental yields.

- Affordability: Assess the affordability of properties in your preferred locations, considering factors such as property prices, maintenance costs, and financing options.

- Amenities and Facilities: Evaluate the availability of amenities and facilities in the surrounding area, such as schools, hospitals, shopping malls, and recreational parks.

- Traffic and Congestion: Consider the potential impact of increased traffic and congestion due to the Circle Line’s development. Choose locations with good accessibility and traffic management plans.

- Future Development: Research any planned developments or infrastructure projects in the area that could affect property values and living conditions.

When Will The Project Complete?

The MRT 3 Circle Line project was initially estimated to cost RM31 billion, excluding land acquisition costs of approximately RM8.4 billion. The current projected cost is RM45 billion, down from an earlier estimate of RM68 billion. Construction is expected to begin in 2026, with completion and operations anticipated by 2032.

The MRT3 Circle Line represents a significant milestone in the development of the Klang Valley. It offers a wealth of real estate investment opportunities, from established neighbourhoods to emerging hotspots. By carefully considering factors such as property type, location, developer reputation, and future prospects, investors can capitalise on the Circle Line’s transformative impact and reap the rewards of their investments. For more information about the MRT 3 Circle Line, visit their official microsite.

The information regarding the proposed alignment and stations of the MRT 3 Circle Line has been sourced from the MRT Corp website and is subject to change. All details provided, including station locations and alignment plans, are based on current proposals and may be revised as the project progresses. For the latest updates and official information, please refer directly to the MRT Corp website or contact MRT Corp for further clarification.