Sometimes people make verbal agreements when renting out property because it’s quicker and cheaper than creating a written contract. They might just shake hands and trust that everything will go smoothly. But this isn’t a good idea because if there’s a disagreement later on, it can be really hard to sort out. This is especially true if the landlord and tenant remember things differently.

Also, when you make a verbal agreement, you might forget to include important details like how much the tenant needs to pay if they break something. It’s much better to get a legal expert to help you create a written contract so that everything is clear and there are no surprises down the line.

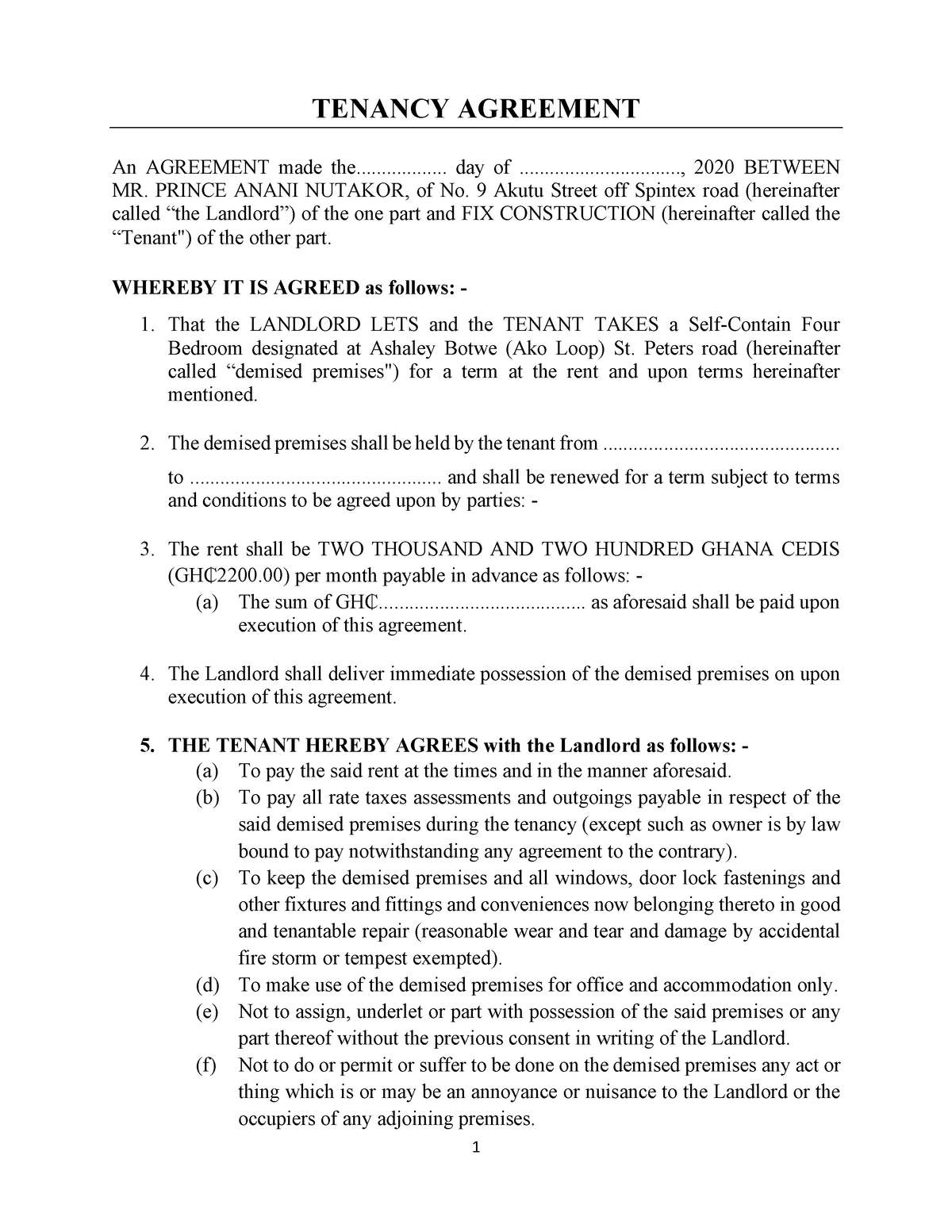

What is a Tenancy Agreement?

A tenancy agreement is a legal contract between a landlord and a tenant that lays out what each party is responsible for during the rental period. It also describes the rental property and any furniture or amenities that come with it.

It’s a good idea for landlords to hire a lawyer to create a comprehensive tenancy agreement, and for tenants to have a lawyer look over the contract and suggest any changes before agreeing to it.

However, hiring a lawyer can be expensive, so some landlords in Malaysia may create their own tenancy agreement and ask tenants to agree to it. It’s important to note that there are currently no federal regulations in Malaysia that define what a tenancy agreement should include. This means that either the landlord or tenant can add terms and conditions that benefit them, making the contract more advantageous to one party.

What to Include in a Rental Agreement?

When it comes to a tenancy agreement, there’s a lot that needs to be spelled out. It’s important to use clear and precise language so that everyone is on the same page and there’s no confusion.

Basically, a tenancy agreement should cover the following:

Property Details

When you’re putting together a tenancy agreement, it’s important to be crystal clear about the property details. Tell the tenant what kind of place they’ll be renting and where it’s located. If it’s a condo, don’t forget to mention the unit number.

Let the tenant know if they’ll be renting out the whole place or just a part of it, like a room. And be upfront about the property’s condition – is it lacking fixtures, furniture, and appliances, or will it come with all the bells and whistles like a fridge, AC unit, and cooking gear? If it’s the latter, the landlord should provide an inventory list so the tenant knows what’s included. And before signing on the dotted line, the tenant should double-check to make sure everything’s there and in good condition.

Rental Amount and Deposits

Make sure your tenancy agreement includes the monthly rent amount and when it’s due. Let the tenant know how they can pay (like cash, bank deposit, or wire transfer).

It’s also important to state the amounts for the earnest deposit, security deposit, and utility deposit. That way, there’s no confusion about how much money the tenant needs to fork over upfront.

Tenancy Period and Renewal Options

When you’re creating a tenancy agreement, it’s important to be specific about the rental term and duration. This refers to the fixed period of time that the tenant will be renting the place.

Typically, tenancy periods are based on a year-by-year basis, with one-year, two-year, and three-year periods being the most common. It’s worth noting that any rental agreement for a period exceeding three years is considered a lease rather than a tenancy. If the rental is on a monthly basis, make sure to mention that instead.

Be sure to include the date when the contract is signed, the starting date of the rental period, and the date when it will end. You may also want to include clauses allowing the tenant to renew or extend the tenancy for a specific period, subject to certain conditions.

Landlord Responsibilities

The landlord has certain duties too, such as paying the annual property tax, ensuring the property is insured and the premiums are paid, and maintaining the furniture and appliances provided in good working order.

As a landlord, you should also be aware of rental income tax. This means you may be taxed for the money you earn from renting out your property, so it’s important to keep this in mind.

If you earn money from renting out a property, you’ll need to pay rental income tax, similar to Real Property Gains Tax (RPGT) when selling a property.

But don’t worry, there’s a silver lining! You can get a 50% income tax exemption on your rental income. Just make sure you meet the criteria below:

- Applicable for residential properties only

- You must be a Malaysian resident individual

- Rental income earned does not exceed RM2,000 per month per property

- The property is rented under a legal tenancy agreement between owner and tenant

- Tax exemption is given for a maximum period of 3 consecutive years of assessment

- Effective for tenancies made in the year of assessment 2018 to 2020

Tenant Obligations

The tenant has a few obligations that they need to fulfil during their tenancy. These include paying the rent and utilities on time, taking care of the furniture, appliances and interiors provided by the landlord, informing the landlord of any issues or defects in the property, and following the rules and regulations set by the condominium and the landlord.

House Rules, Prohibitions and Limitation

State the rules and restrictions that the tenant must follow while staying in the property. This may include prohibiting subletting the property or any part of it, using the unit solely for residential purposes, and refraining from conducting any illegal activities that may jeopardize the property’s insurance coverage.

Additionally, tenants should be informed not to carry out any renovations on the property and to comply with limitations set by the landlord, such as allowing only a specific number of individuals or one family to occupy the home.

How to Resolve Dispute

In this section, the process for resolving disputes is outlined. This is necessary in case any issues are not specified in the tenancy agreement or if there are any disagreements or misinterpretations between the landlord and tenant regarding certain clauses or terms in the contract.

How much do tenants need to pay for deposits and what are they for?

In Malaysia, landlords commonly request tenants to make additional payments aside from the monthly rent. These include the Earnest Deposit, Security Deposit, and Utility Deposit.

Earnest Deposit

The Earnest Deposit is a payment made by the tenant to secure the rental unit for the next seven days and prevent the landlord from renting it out to other potential tenants. Typically, this deposit amounts to one month’s rent and may be held in escrow by a real estate agent.

The tenant usually submits the deposit to the landlord along with a “letter of offer,” which states their intention to rent a particular property. When the tenancy officially begins, the Earnest Deposit is often applied as the first month’s rent. However, it may also be returned to the tenant or used as the Security Deposit.

Security Deposit

The Security Deposit serves as a form of assurance for the landlord in case of any breaches committed by the tenant, such as early termination of the tenancy. However, if the tenant fulfils their obligations and there are no issues during the rental period, the entire amount will be returned at the end of the tenancy.

This deposit usually amounts to two months’ worth of rent, and can be used to cover expenses for damages, replacements, cleaning, and key replacement in the event that the tenant abandons the property.

Utility Deposits

The Utility Deposit is collected to cover any unsettled utility bills by the end of the tenancy period, such as water, electricity, gas, and sewerage. It usually amounts to half a month’s rent in Malaysia, although the landlord may opt to collect a full month’s rent if the half-month amount is insufficient. It is important to note that both the Security Deposit and Utility Deposit are paid to the landlord upon signing the Tenancy Agreement.

The Security Deposit acts as a bond that can be used to cover any damage or breach of contract by the tenant, while the Utility Deposit covers outstanding utility bills.

How much does the Stamp Duty for a Tenancy Agreement cost?

After both the landlord and tenant agree to the terms and conditions stated in the tenancy agreement, they need to sign it along with all the pages of the contract. Additionally, both parties are required to have a witness sign the deal along with all of its pages. However, it’s important to note that the agreement is not considered legally binding or admissible in court until it’s stamped by the Malaysia Inland Revenue Authority or Lembaga Hasil Dalam Negeri Malaysia (LHDN).

Prior to obtaining the LHDN stamp of approval, the payment of Stamp Duty is required. It is important to note that in Malaysia, it is the tenant’s responsibility to pay for the stamp duty fees as outlined in the third schedule of the Stamp Act 1949. The landlord/seller is not liable for this payment.

LHDN office may request that you complete two application forms – namely PDS 1 and PDS 49(A).

- Stamp duty payable for Tenancy Agreements lasting less than one year is RM1 for every RM250 of the annual rent exceeding RM2,400.

- For agreements signed for 1 to 3 years, the stamp duty rate is RM2 for every RM250 of the annual rent exceeding RM2,400.

- Meanwhile, for agreements exceeding 3 years, the stamp duty rate is RM3 for every RM250 of the annual rent exceeding RM2,400.

Suppose you have a monthly rental of RM2,000 for a one-year tenancy, which translates to an annual rent of RM24,000. To calculate the Stamp Duty, subtract RM2,400 from RM24,000 to get RM21,600. Then, divide RM21,600 by 250 and multiply the result by RM1 to get RM86.4 in Stamp Duty.

To ensure that the tenancy contract becomes legally binding and admissible in court, it is recommended to request the LHDN staff to stamp the original copies of the contract for the landlord, tenant, and property agent (if involved).

Stamp duty aside, what other fees are involved in the rental agreement?

When preparing your tenancy agreement, it’s important to consider two additional fees: administration fees and legal fees. The administration fee is a one-time payment that is calculated based on the monthly rental amount and is paid by the tenant to the landlord. While there are general recommendations for the amount of the administration fee, the final decision on the amount is at the discretion of the landlord or real estate agency.

| Rental Per Month | Estimated Admin Fees |

|---|---|

| < RM1,000 | RM100 |

| > RM1,000 to RM1,999 | RM150 |

| > RM2,000 to RM3,000 | RM200 |

| > RM3,000 to RM4,000 | RM250 |

| > RM4,000 | RM300 |

How to calculate legal fees for tenancy agreement in Malaysia

Apart from the administration fees and monthly rent, there are additional fees that need to be settled before a tenancy can be completed, particularly at the start – legal fees. Unlike stamp duty and admin fees, legal fees are determined based on the length of the tenancy agreement, with a baseline of 3 years (whether shorter or longer than 3 years). Here is a general guide: If the tenancy period is less than three years, the payable legal fees are as follows:

| For the first RM10,000 of annual rent | 25% of the monthly rent |

| For the next RM90,000 of annual rent | 20% of the monthly rent |

| Where the annual rent is in excess of RM100,000 | Negotiable |

If the rental period is more than three years (lease), the legal fees payable are as below:

| For first RM10,000 of annual rent | 50% of the monthly rent |

| For the next RM90,000 of annual rent | 20% of the monthly rent |

| Where annual rent is in excess of RM100,000 | Negotiable |

In Malaysia, it is common practice for both the tenant and landlord to share the legal fees instead of the tenant being solely responsible for the cost.

Components in the Tenancy Agreement

Your Tenancy Agreement needs to be divided into various parts, as listed:

- Cover page with date, landlord and tenant’s details (names, IC numbers).

- Terms of the agreement, including who is referred to as landlord, tenant, and the premises.

- Duration of tenancy, deposits, and rental amount.

- Tenant’s responsibilities and obligations, such as paying rent on time and settling utility bills.

- Landlord’s responsibilities and obligations, such as insuring the property and paying taxes.

- Special conditions or clauses agreed upon by landlord and tenant for exceptional cases.

- Definitions of terms like “tenant,” “landlord,” rental amount, and duration of stay.

- Signatures of landlord, tenant, and witnesses.

- Schedule section with pertinent information such as property address, contact details, and other terms and conditions.

- Inventory list of items supplied by the landlord that are expected to be returned in working condition.

For a quick and easy guide, below is the typical rental process in Malaysia:

- Identify a potential property and arrange a viewing with the landlord or agent.

- Check the property thoroughly during the viewing to ensure it meets your requirements and standards.

- Negotiate the rental rate and deposit amounts with the landlord or agent.

- Once you have agreed on the terms, the landlord will issue a “Letter of Offer” to confirm the rental agreement.

- Provide an earnest deposit to the landlord to secure the property. This deposit will usually be one or two months’ worth of rent.

- Within 7-14 days of paying the earnest deposit, both parties will prepare and sign the Tenancy Agreement, which outlines the terms and conditions of the rental agreement.

- The tenant will be required to pay a security deposit, usually equivalent to two months’ rent, as well as utility deposits.

- The signed Tenancy Agreement will be stamped by the Inland Revenue Board of Malaysia (LHDN) to make it legally binding.

- Both tenant and landlord will receive a copy of the stamped agreement.

- The landlord will hand over the keys to the property to the tenant.

- It is recommended that the tenant informs the landlord of any damages or issues with the property that were missed during the viewing.

- The tenant is responsible for paying rent and utilities on time and maintaining the property in good condition throughout the tenancy.

Leave a Reply